brookfield properties stock canada

Top Losers is the list of biggest percentage decliners. 2 brokers have issued twelve-month price objectives for Retail Properties of Americas stock.

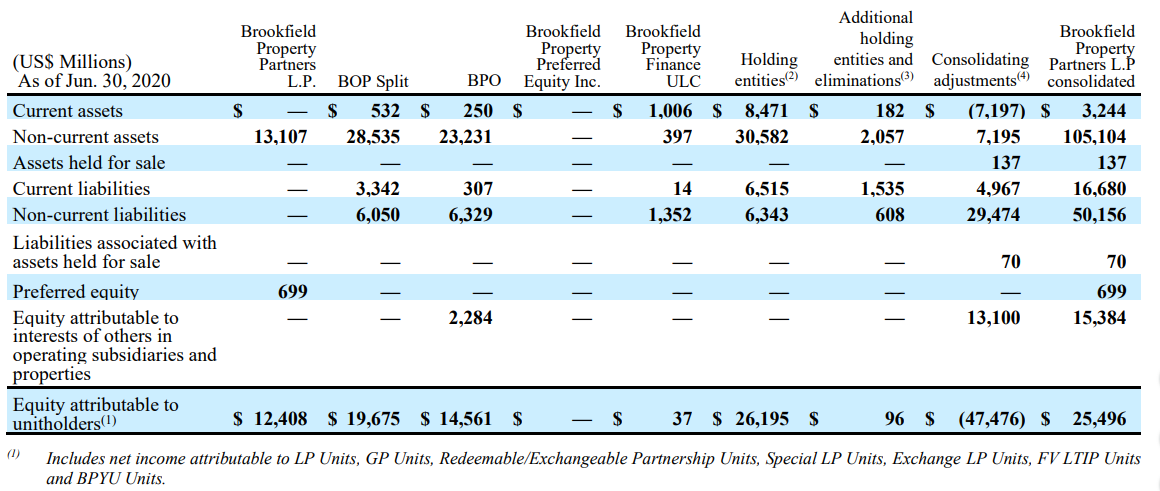

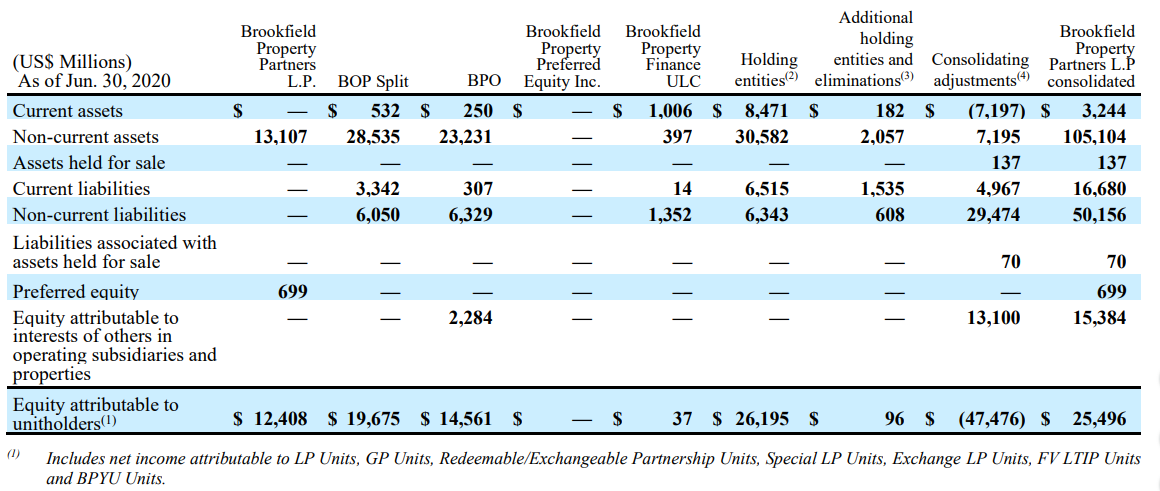

Brookfield Property Partners Has A Structurally Superior Preferred Nasdaq Bpy Seeking Alpha

Canada Stocks Stay on top of current data on the stock market in Canada including leading stocks as well as large and small cap stocks.

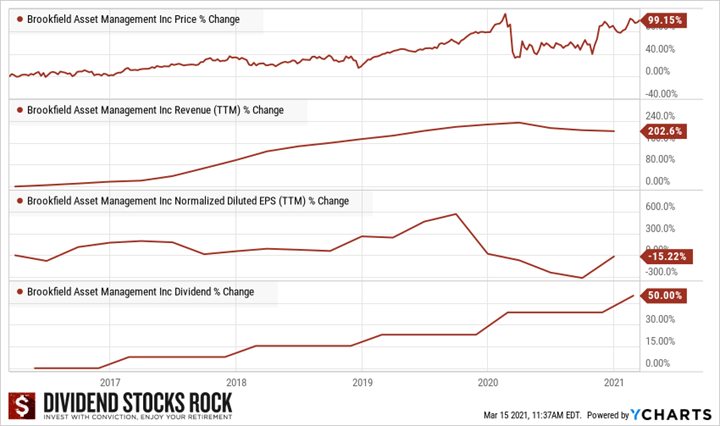

. Is a Canadian multinational company that is one of the worlds largest alternative investment management companies with US688 billion of assets under management in 2021. Their forecasts range from 1400 to 1400. Stocks that have lost the most value Canadian Stock Market.

On average they expect Retail Properties of Americas stock price to reach 1400 in the next twelve months. Brookfield Asset Management is a leading global alternative asset manager with over 600 billion of assets under management across real estate infrastructure renewable power private equity and credit. The company invests in distressed securities through.

But all while this is happening green energy companies here in Canada are quietly amassing large asset bases and production capacities. It focuses on direct control investments in real estate renewable power infrastructure credit and private equity. Its an investment gold mine.

Medical Properties Trust is a REIT that focuses as its name indicates on medical properties -- primarily acute care hospitals. Is a publicly owned asset management holding company. Brookfield Asset Management Inc.

The firm specializes in early stage acquisition distressed investments short-term financing to mid-market companies corporate carve-outs recapitalizations convertible senior and mezzanine financings operational and capital structure restructuring strategic re. This suggests a possible upside of 65 from the stocks current price. The stocks can continue their downward movement which is why its important to identify the reasons why stocks have been falling.

Click on individual stocks for additional information. Its dividend yield of 486 is especially attractive. Our objective is to generate attractive long-term risk-adjusted returns for the benefit of our clients and.

Brookfield Asset Management Inc. Many traders prefer to buy low and sell high and we provide the tools to do that. Your best bet as an investor is to funnel out the noise and instead take a position in a strong TSX listed renewable energy stock.

Simplenexus Secures 108m To Transform The Homeownership Journey Into A Seamlessly Connected Ex Home Ownership Home Buying Process Series B Funding

Canada Real Estate Development Projects Brookfield Properties

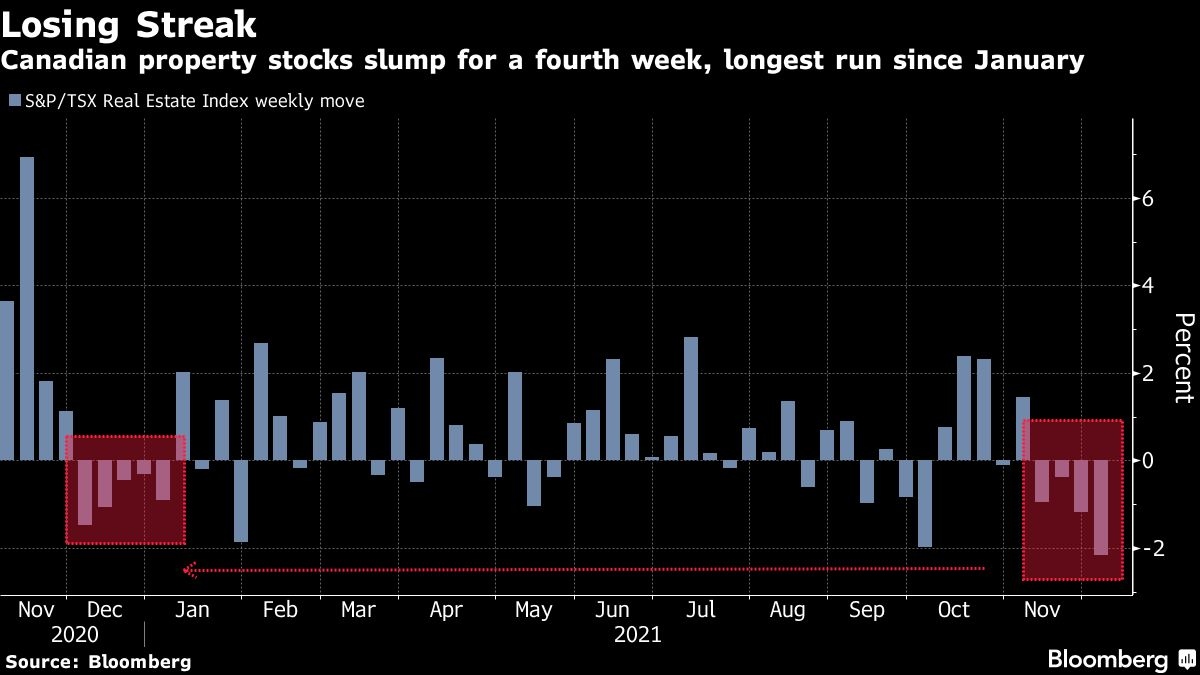

Residential Reits In Canada Lag As Trudeau Weighs Investor Curbs Bnn Bloomberg

Canada Real Estate Development Projects Brookfield Properties

Is Brookfield Property Partners Stock A Buy The Motley Fool

Download This Photo In Toronto Canada By Maarten Van Den Heuvel Mvdheuvel Lugares Incriveis Para Visitar Morar No Canada Lugares Para Visitar

Canadian Real Estate Stocks Slide In Worst Streak Since January Bnn Bloomberg

Meridian Sells 175 000 Sf Office Building In Contra Costa County For 31 Million Contra Costa County Meridian Commercial Property

Tycoon Robert Kuok S Record Payment For Land In Johor Is Talk Of The Town In M Sia S Pore Business Finance Malaysia Personal Finance Advice

Canada Real Estate Development Projects Brookfield Properties

Brookfield Stocks Which Type Of Shares Should You Hold Seeking Alpha

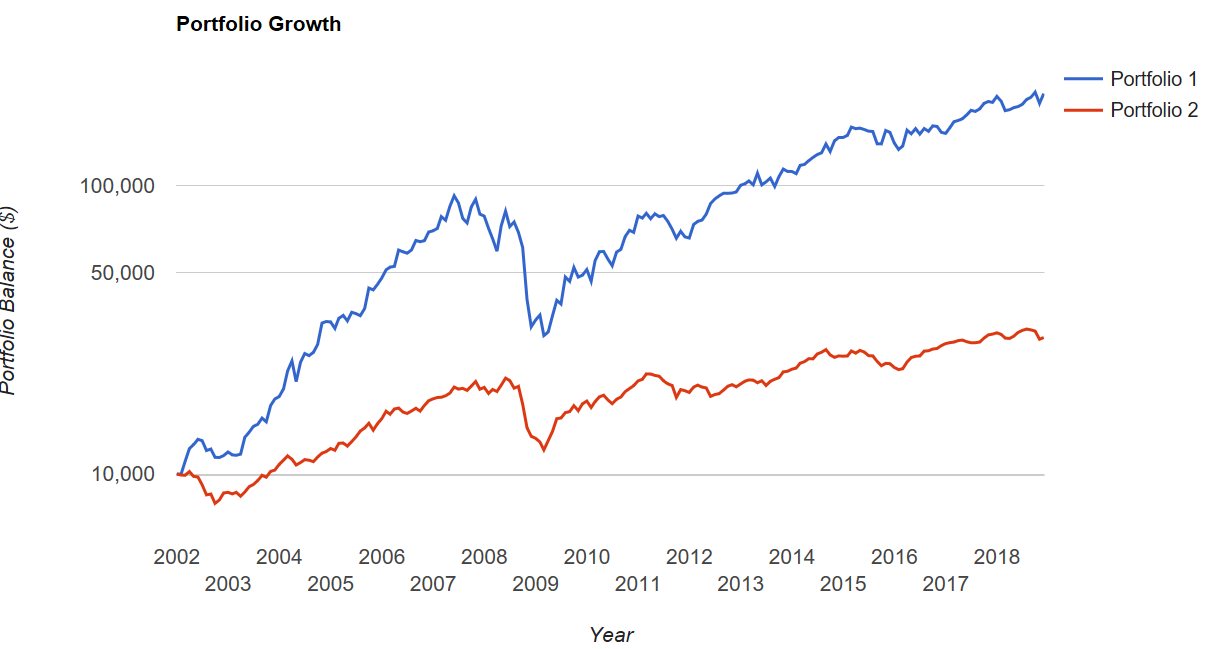

The Canadian Wide Moat 7 Dividend Growth Portfolio Bam It S Now 11 Nyse Bam Seeking Alpha

Brookfield Property Buyout Fair Value Would Be 20 Koneko Research

Nadaaa Proposes A New School Of Architecture For Toronto Architecture School Architecture Public Architecture

Canada Real Estate Development Projects Brookfield Properties

Godrej Properties To Launch Godrej Greens Project In Pune For 300 Apartments Projects Property Residential

Canada Real Estate Development Projects Brookfield Properties

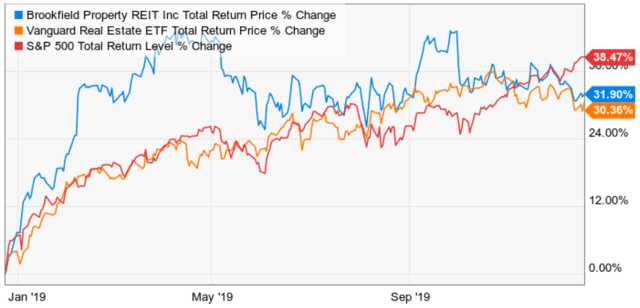

3 Reasons Brookfield Property Is One Of The Best Reits You Can Buy For 2020 Nasdaq Bpyu Seeking Alpha