tn franchise and excise tax exemption

FE-4 - Tennessee Filing Requirement for an LLC that Files Federally as an Individual or Division of a General Partnership. Industrial Development Corporations Masonic lodges and similar lodges Regulated Investment.

Tennessee Cpa Journal July August 2015 Page 32

At least 95 of the entitys ownership must be directly held by family members and.

. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. Thank you for submitting your Franchise and Excise Tax Annual Exemption Renewal FAE 183 online at Tennesseegov. The excise tax is based on net earnings or income for the tax year.

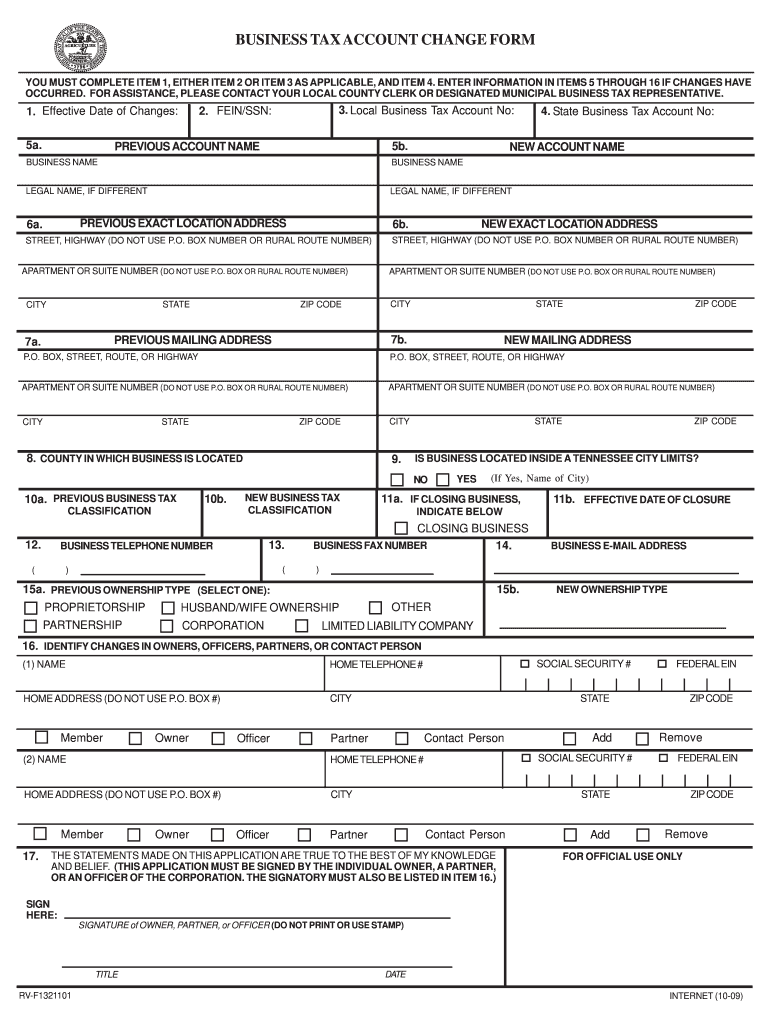

67-4-2008 provides exemption from Tennessees franchise and excise taxes under certain situations. Tennessee Code Annotated Section 67-4-2008 provides exemption from Tennessees Franchise and Excise Taxes under certain situations. The form on the reverse side should be.

You can read frequently asked questions about the Family Owned Non-Corporate Entity Exemption FONCE exemption for franchise and excise tax here. In order to qualify for the FONCE franchise and excise tax exemption the entity must meet two criteria. Your confirmation details are below.

All entities doing business in Tennessee and having a substantial nexus in. Any entity that fails to timely file an application for exemption or renewal may be charged a 200 penalty per occurrence. The exemption will simply be applied to the following tax period.

Seventeen different types of entities are exempt from the franchise and excise taxes. Important Notice 09-05. Download or print the 2021 Tennessee Form FAE-183 Franchise and Excise Tax Annual Exemption Renewal for FREE from the Tennessee Department of Revenue.

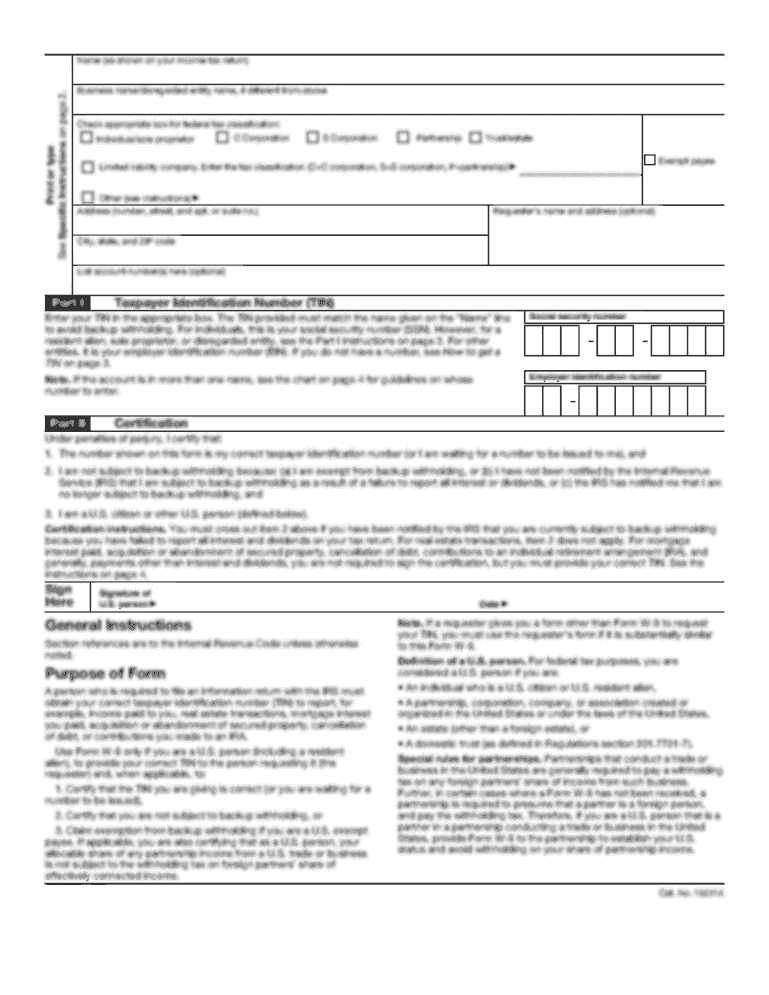

Who is exempt from franchise and excise tax in Tennessee. Application for Registration and Instructions Application for ExemptionAnnual Exemption. The Application for Exemption should be completed by entities.

The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property. FE-5 - Due Date for Filing Form FAE170 and Online Filing. FE-9 - Extension for Filing the Franchise and Excise Tax Return To receive a six month extension a taxpayer must have paid on or before the original due date an amount.

The excise tax is 65. The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise registered. The excise tax is based on net earnings or income for the tax year.

A completed franchise and excise tax return FAE170 must be filed electronically with a minimum 100 payment of any taxes due by the 15th day of the fourth month following the. Filing of Tennessee Form FAE 183 or FAE 170 For the exemptions discussed above the entity will. Franchise Excise Tax - Excise Tax All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from.

Online Registration using the Tennessee Taxpayer Access Point TNTAP. Next if you dont file the proper exemption a Tennessee LLC is subject to a franchise and excise tax for the privilege of doing business in their State. To qualify for the franchise and excise tax venture capital fund exemption the venture capital fund must be a limited liability company limited liability partnership limited.

Tennessee Business Taxes Fees A Primer

More Help Available For Tennessee Business Owners

Fill Free Fillable Forms State Of Tennessee

.jpg)

Saltreport November 11 2014 Nareit

Predators Edition All Caps All The Time For Tennessee S Franchise Excise Tax Obligated Member Exemption Carter Shelton Jones Plc

Michael T Odom Cpa Fouts Morgan Cpas August 26 2009 Ppt Download

Printable Tennessee Sales Tax Exemption Certificate Fill And Sign Printable Template Online Us Legal Forms

Tn Dor Fae 183 2021 2022 Fill And Sign Printable Template Online Us Legal Forms

Tdor Rules Entity Doing Business In Tn For Franchise Excise Taxes

Tennessee Franchise And Excise Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Tennessee Budget Primer The Sycamore Institute

Tennessee Franchise Tax Update Tenneessee Tax Faq

Tennessee Rentals And The Fonce Exemption Mark J Kohler

Tennessee Franchise Excise Tax Part Ii Price Cpas

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Tennessee Creates New Tax Benefits For The Film And Television Industry Pillsbury Seesalt Blog Jdsupra

Tennessee Clarifies The Application Of Marketplace Facilitator Legislation To Franchise Excise Tax Forvis

Tn Rv F1321101 2009 2022 Fill Out Tax Template Online Us Legal Forms